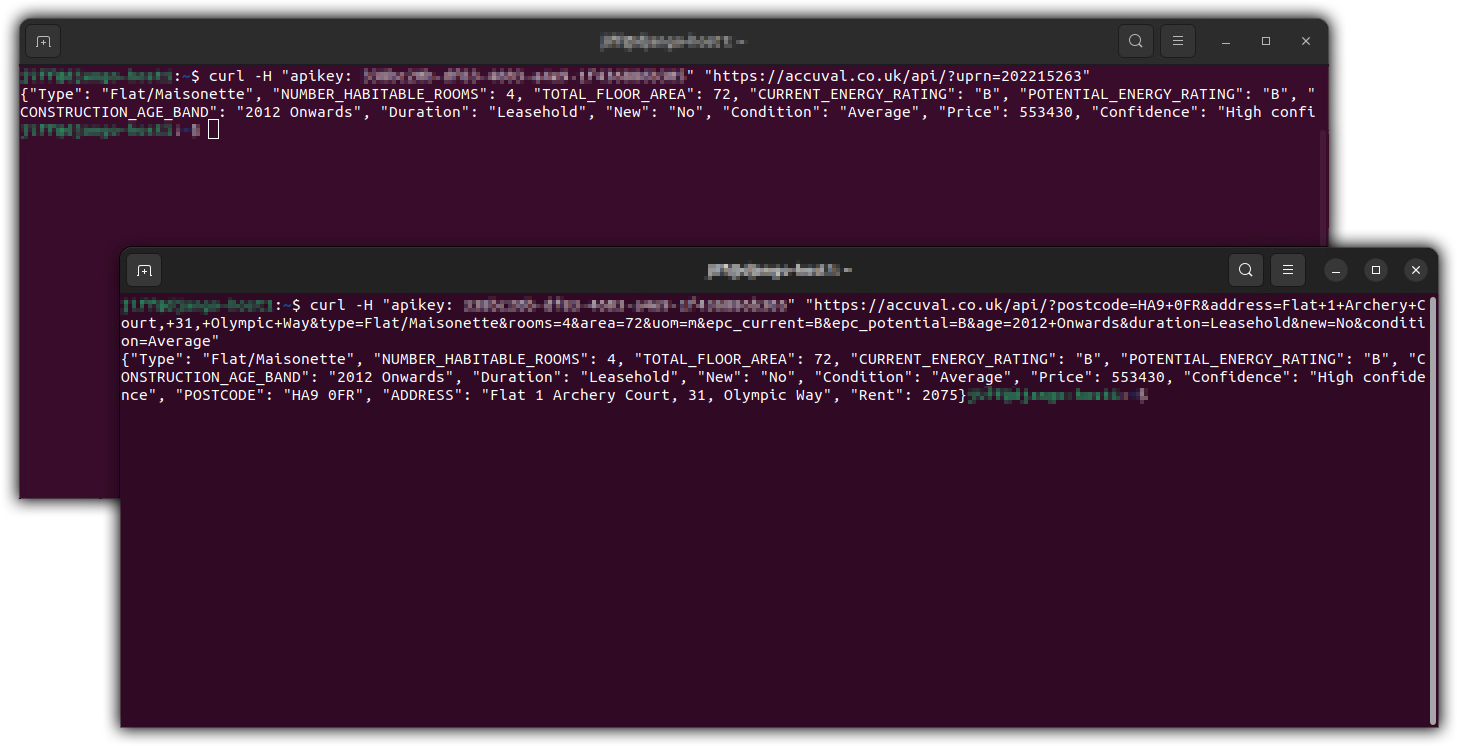

Automated Valuation Model (AVM) API, Powered by AI

Our valuation APIs are the most sophisticated in the UK. They are underpinned by state-of-the-art AI that can value any property with accuracy levels never seen before. What’s even more exciting is that accuracy only gets better and better over time, thanks to AI.

Who is it for?

Our automated Valuation as a Service allows lenders, housing insurers, social housing and local authorities to automate their property valuation process while saving up to 90% of surveyor cost, and time.

Top 5 Reasons to Choose AccuVal

1. Saves headache, and money

Automated valuation can reduce cost by £200 or more per property, especially in hard-to-reach locations.

2. Ridiculously fast!

Each valuation is completed in milliseconds. Thanks to our efficient implementation, our API back-end (i.e. Server) can handle many APIs requests simultaneously without a hitch.

3. Values any property, real or fictitious!

Thanks to AI, AccuVal can value any existing property as well properties that are yet to exist. It can also estimate the potential value of any property after renovation or expansion. The perfect tool for what-if scenarios.

4. Social Housing Valuation

AccuVal helps Local authorities and housing associations save millions in surveyor cost, thanks to the ability to do EUV-SH valuations (Existing Use Value – Social Housing).

5. Liquidity Score

We know that for investors, lenders and mortgage brokers, finding out the liquidity of the property (i.e. how fast it could be sold for its fair market value) is as important as the price. Our ALIS (AccuVal Liquidity Index Score) does just that, instantly.